Market Update: What’s Happening with Mortgage Rates?

February 28, 2025

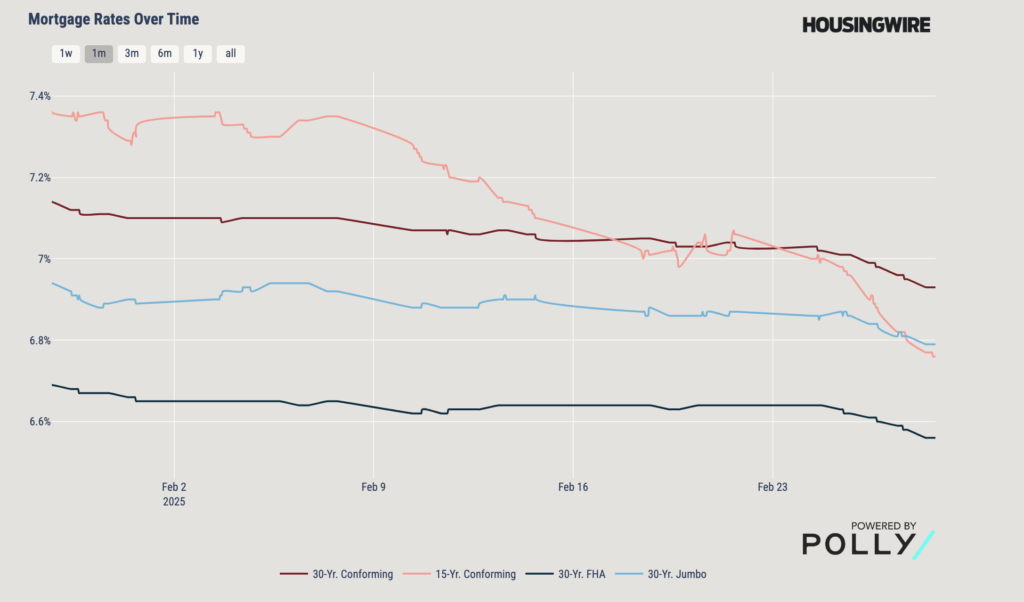

Mortgage rates have been slowly trending down in recent weeks, even though the Federal Reserve decided to pause its rate-cutting cycle. As of this week, the average 30-year fixed mortgage rate is 6.89%, slightly lower than last week.

What’s Causing the Rate Fluctuations?

The mortgage market is constantly adjusting based on economic news, government policies, and investor expectations. One major factor affecting mortgage rates is uncertainty around inflation and interest rate policies. If inflation remains high, the Federal Reserve may need to raise rates again, which could push mortgage rates back up.

What does this mean for Charlotte? More Listings, More Negotiation Power for Buyers.

The Charlotte region saw a boost in housing inventory as new listings rose 11.3% year over year in January, adding about 411 properties to the market. Total active listings reached 8,204, marking a 32.7% annual increase. While inventory levels remain low in many areas, outlying markets like Kings Mountain, Lincolnton, Salisbury, and Shelby saw higher supply levels.

Buyer demand remains steady, with 3,320 homes going under contract in January—on par with last year and up 26.2% from December. However, sellers are increasingly adjusting prices and offering concessions to attract buyers, providing more opportunities for negotiation. The median home price increased 2.7% year over year to $385,000, while the average sales price climbed 9.1% to $491,285.

Buyer interest remains strong, and industry experts anticipate an active but competitive spring market. With homes spending an average of 57 days on the market—15 days longer than a year ago—buyers may have more time and leverage to secure favorable deals. We are seeing this personally.

Opportunities Are Growing—Make Your Move Today!

With more homes hitting the market and sellers offering price cuts and concessions, now is a great time to buy. Whether you’re searching for your dream home, vacation home or a rental property, having a smart financing plan can make all the difference.

Kris Steele is here to help. Ranked in the top 1% of loan officers in North Carolina, Kris brings over a decade of mortgage expertise—plus real-world experience buying, selling, and managing investment properties. He knows the challenges and opportunities buyers face and can help you secure the best loan options for your goals. Ready to make a move? Let’s talk strategy.